Inside Minah #1 - Launching Minah

We are delighted to announce the launch of Minah.io : the investment platform that makes it simple to invest in positive impact projects in Africa.

The future of the African continent is being shaped today. We are convinced that combining traditional finance with new technologies is the key to unlocking its full potential.

With Minah.io we aim to contribute to the shaping of tomorrow's world; a world where financial profitability is also synonymous with sustainability.

The platform's ambition is simple: bring together the best investment opportunities in sub-Saharan Africa by reconciling financial return with a solution for the sustainability challenges faced by the continent.

To achieve this, we are creating an ecosystem of players from diverse and varied backgrounds, all united around a single common goal: accelerate the development of the African continent.

In this monthly newsletter, we will present the vision of the Minah team. You'll be able to learn more about how the platform works, and we'll keep you up to date with the key stages of its development. We will also endeavour to share with you qualitative content on the many investment opportunities that exist in Africa, as well as on the continent's economic environment.

Welcome to Inside Minah.io and as we say in Togo: Woezon looo!

We believe there is a lack of sense in the financial system. In a context of globalized flows, we should have more choice and transparency in the projects in which we commit our savings.

Africa: a land of opportunity

While the world has long watched the lightning economic and demographic rise of China, all eyes are now turning to Africa, seen as the next driver of global growth. This anticipation is based on a series of promising indicators that illustrate an accelerating dynamic across the continent.

Demographic growth: According to recent UN projections, the population of Sub-Saharan Africa is set to double by 2050, to 2.5 billion people. This demographic leap would mean that the continent alone is likely to account for a quarter (25%) of the world's population, compared with just 10% in 1950. This rapid growth, coupled with increasing urbanisation, offers immense economic potential, but also raises significant challenges with regard to infrastructure, education and health.

Economic growth: Sub-Saharan Africa is distinguished by some of the highest GDP growth rates in the world. Countries such as Senegal (with growth of +9.4%), Rwanda (+7.9%), Côte d'Ivoire (+7.1%), Togo (+6.3%) and Benin (+6.4%) illustrate this trend (Source: African Development Bank). This growth is sustained in particular by solid economic diversification and improved regulatory frameworks.

Surges in technological adoption : The adoption of technologies, especially Mobile Money (MoMo), is a striking example of the continent's capacity for innovation. The region now accounts for more than 50% of the world's open mobile money accounts, having doubled in less than five years. This rapid adoption is a testament to Africa's flexibility and ingenuity in dealing with new technologies, offering promising prospects for economic development and financial inclusion.

An increasingly young population: Africa has a particularly young population, with 70% of Sub-Saharan Africans aged under 30 and a median age of 18.6 in 2021. This young demographic represents both a challenge in terms of employment and education and a unique opportunity to stimulate innovation and economic dynamism on the continent.

These few non-exhaustive facts and trends paint a favourable economic picture for Africa. It might be tempting to conclude that these factors are stimulating a wave of investment and the launch of ambitious new projects on the continent. The reality on the ground reveals a more nuanced picture.

Indeed, despite this favourable context, a reluctance persists within the private investment community. This reluctance to commit capital on a larger scale to Africa is often attributed to a number of risk factors: political instability, regulatory challenges, inadequate infrastructure, and a lack of transparency in certain sectors. These obstacles, whether real or perceived, are holding back the momentum that economic and demographic indicators could inspire.

Theory versus practice

According to the principles of modern economics, financial markets should theoretically allow for an efficient and fair allocation of financial resources and capital. (Eugene Fama - Nobel Prize in Economics 2013).

Thus, given the economic performances observed in Africa and considering the forecasts for the coming years, we could naturally expect a substantial inflow of capital to support the wealth being generated locally.

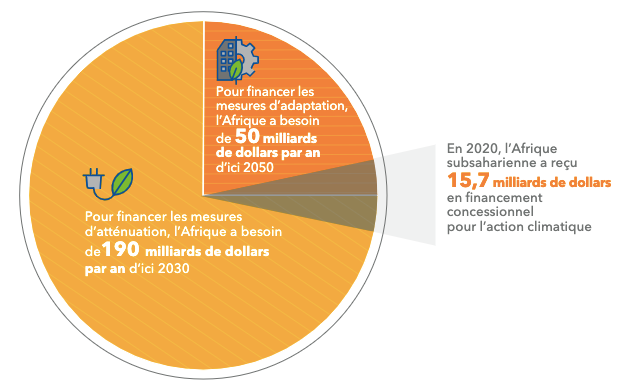

However, despite these favourable economic prospects, the volume of capital flowing into Africa does not match the colossal needs that have been identified. Although a significant amount of FDI (Foreign Direct Investment) is directed towards the continent, these flows remain insufficient to support its development. In 2022, FDI flows were even on the decline, with a drop of €45 billion compared with 2021. Furthermore, according to the Ecofin agency, the investment needed to develop infrastructure on the continent is estimated at around 150 billion dollars a year, but there is a financing gap of between 45 and 70% of this amount. This financing gap can be found in several areas of the economy, particularly in the needs to stem the consequences of climate change. See chart below.

These figures highlight the significant gap between the potential and the reality of investment on the continent. They highlight the fact that the conditions for optimal capital flows to Africa are not in place. A number of market frictions persist, setting up entrance barriers for potential investors. These barriers include :

Information asymmetries

Legal and financial barriers

Operational barriers

The whole point of the Minah platform is to help reduce these entrance barriers. We are creating a resilient and sustainable ecosystem, using technology to break down these constraints. We are building a bridge to turn African opportunities into reality.

Improving financial streams allocation

To some extent, this financial bridge already exists. Each year, the amounts sent home by the African diaspora are significant and continue to rise. According to the World Bank, they represent 54 billion dollars in 2023, or 1.9% more than in 2022. They are a significant element in the overall funding of the continent's economies, and for some countries they even represent larger budgets than those allocated to development.

However, these flows are not enough to create a truly efficient investment channel. While around 15% of the sums sent are generally devoted to real estate investment, they are often made in a family, non-professional framework, with real difficulty in generating financial performance.

In addition to these diaspora flows, other "Afro-optimists" or investors are also looking to invest in this region. Unfortunately, without strong family ties or a local presence backed up by relationships of trust, it is difficult to find the information, opportunities and people capable of carrying out sustainable projects.

The only solutions often lie in philanthropy via NGOs or associations, but in such cases they are far from a profitable investment perspective.

With Minah.io we want to solve this problem and offer a simple solution that allows individual investors to allocate more resources to projects on a human scale. To do this, we are tackling 3 main challenges:

Identify promising projects and make them simple: Reducing these entry barriers means working to make opportunities simpler. We have a diversified and clear investment offer by highlighting the essential characteristics of projects in exhaustive information memos, including both financial and non-financial data. The aim is to reduce the number of grey areas as much as possible, despite the cultural and geographical distance involved.

Reduce transaction costs: To date, very few services exist for sending funds to Africa at low cost. There are specialized operators such as Western Union, Ria and MoneyGram, but the transaction fees applied are such that it is difficult to consider large flows at reasonable costs. In Q2 2023, the average cost of sending $200 to the continent was estimated to be around 8%. The Minah.io platform is built around a set of cutting-edge technologies that enable us to offer low transaction rates and thus make international money transfers seamless.

Ensure liquidity: Development projects often take a long time to complete (10 years or more). These long investment periods do not necessarily correspond to the short- to medium-term constraints of private investors, who tend to aim for investment exits of around 5 years. With Minah.io, we want to unleash the potential of investment and enable anyone to contribute to financing without being locked in for the entire duration of the project. The technology and players brought together on the platform make it possible to provide users with liquidity and recover their investments.

We are convinced that resolving these issues will help to improve the fluidity of flows from the Diaspora and even encourage new people to contribute to Africa's development.

The new generation finance

The final element of Minah's DNA is our conviction that modern finance must be responsible and sustainable. The current financial model needs to be re-thought so that it takes into account the environmental and social challenges for which we will collectively have to find a solution.

Without claiming to provide the perfect solution to these major challenges, we wish to participate in the common effort and contribute to their resolution. This is why the investment projects available on the Minah platform will systematically respond to several of the UN's Sustainable Development Goals (SDGs).

These Goals are universal standards, which will enable us not only to standardise our approach with international players, but also to easily measure and disseminate the impact level of our projects.

The platform's first projects will have to be in line with the following 3 SDGs:

Obviously, the project is set to evolve and the list of SDGs we wish to follow may grow in the future. However, the foundations of our sustainability thesis will remain the same and we will keep the development of extra-financial value generation as the backbone of our development.

Our value proposal

Our project is ambitious: we want Minah.io to become the largest platform for financing positive-impact projects in Africa.

The platform's very first project is located in Lomé, Togo. It is currently in the pre sale phase, and you can already sign up to be one of the first contributors.

We will then expand our offering with new projects in other French-speaking African countries before rolling out across the whole of sub-Saharan Africa.

Our short-term deployment also includes a BtoB offering to help develop larger-scale projects.

There are many challenges ahead and we will not be able to meet them alone. If you want to be part of the adventure, feel free to subscribe to this newsletter, follow us on social media and even contact us if you have any suggestions!

Herve & Julien